The Future of Gold – with REXA Mining/Metals Manager, Mark Ferra

The deadly COVID-19 pandemic has impacted life as we know it in just about every way possible. Besides being the world’s most serious health-concern throughout 2020 (since there was no known treatment and no vaccine), COVID-19 also led to a significant decline in global markets. For some industries, though, the pandemic actually increased buying and demand. One market in particular, precious metals, saw quite the uptrend through this summer – especially gold. Why, though? We sat down with our very own Metals/Mining Industry Manager, Mark Ferra, to discuss. Without further ado, let’s get right into our interview!

When almost every other industry saw losses amid the COVID-19 pandemic, gold prices surged. Why do you think this was the case?

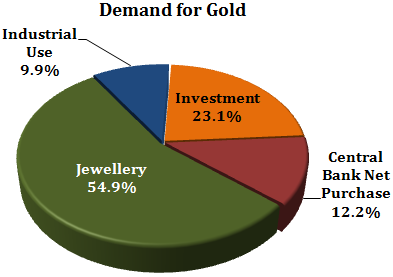

“Gold has always been a sort of “safe haven” for investors during times of uncertainty. Each year, global gold mining adds approximately 2,800 tonnes to the overall above-ground stock of gold. The total above ground stocks are just under 200,000 tonnes, with the majority contained in jewelry. Private investment and government holdings account for less than half (~47%).

This year has been an incredible roller coaster ride in many ways and currently the gold price is just over $1,900 per ounce. Surprisingly, the gold price increases hit a six year high of $1,396 in June 2019. The consensus is that government spending and debt levels drive demand for gold. The COVID-19 pandemic has added further uncertainty. Fears such as a lackluster economic recovery and the current spike in cases we’re seeing so far this winter could revert to nationwide shutdowns. Other COVID-19 pandemic safety measures such as international travel could further slow world economies. In an effort to stimulate the economy back in April, the U.S. government kept interest rates low to incentivize borrowing. This contributed to bond yields decreasing, making gold attractive to investors. Investors are also buying gold because they think it will hold its value if the stock market decreases and inflation increases.”

Do you think this will continue into 2021? Why or why not?

“It is very difficult to say what will occur in the next 6-12 months. I believe uncertainty will remain until after the US presidential inauguration and the wide availability of an effective COVID-19 vaccine.”

What does this mean for gold mines? If this uptrend continues, do you think mines could become overwhelmed with the demand?

“I am noticing an increase in capital expenditures for gold mining projects. Specifically, projects utilizing pressure oxidation leaching (POX) are getting the green light thanks to the increased gold price. For gold miners to move forward, there is confidence that the higher gold prices will continue for the next few years. I don’t think gold miners will be overwhelmed, but the strong demand should keep gold prices high. Other causes for the increased gold demand include institutional and pension funds moving to larger gold positions. In addition, large gold companies such as Newmont and Barrick are both expanding gold production capacity in Latin America.”

Do you think this increased demand (assuming it does continue) will force manufacturing companies like REXA to pivot strategies to incorporate a more gold-focused agenda? If so, why?

“When gold was $1,300/oz less than two years ago, the cost of lost production on an autoclave capable to produce 250,000 gold ounces per year was $34,000 per hour. A shutdown of four hours could mean $133,000 in lost production revenue. With gold at $1,900/oz the same shutdown impact increases 50% to $200,000 in lost revenue. REXA focuses on severe service critical applications where positioning control and reliability are required. At REXA, we would expect a sustained high demand for gold to only increase focus on critical applications such as pressure let down and acid slurry isolation control. The same importance applies to traditional gold mines using flotation cells to separate valuable gold ore. Our actuators are used to position dart valve to maintain a stable pulp level. REXA Electraulic™ actuators are superior to pneumatic actuators in that they provide hydraulic stability to reliably position near the valve seat.”

After the threat of COVID-19 is finally over and other markets bounce back, do you think the gold market will continue this same level of success? Why or why not?

“The COVID-19 pandemic may impact gold demand such that demand will likely be strong for the long term. Distributing vaccines throughout the world has begun, so the end is definitely in sight, but it’s tough to say how quickly things will return to “normal”. The USA accounts for less than 8% of the gold mined worldwide. The increased amount of global government spending due to COVID-19 and associated debt will further escalate market uncertainty.”